The Switzerland market ended marginally down on Wednesday after spending much of the day’s session in negative territory, as investors largely refrained from making significant moves, choosing to wait for more clarity about the quantum of interest rate cut by the Federal Reserve. Although there are expectations the Fed will cut interest rates next month, revised data released by the Bureau of Labor Statistics showing weaker-than-expected job growth has raised some concerns about economic growth.

In this cautious market environment, identifying high-growth tech stocks requires a keen eye for companies with strong fundamentals and innovative potential that can weather economic uncertainties. Let’s explore three promising high-growth tech stocks in Switzerland for August 2024.

Top 5 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 9.25% | 18.37% | ★★★★☆☆ |

| Santhera Pharmaceuticals Holding | 22.30% | 32.48% | ★★★★★★ |

| Temenos | 7.59% | 14.32% | ★★★★☆☆ |

| Comet Holding | 19.03% | 48.25% | ★★★★★☆ |

| Cicor Technologies | 7.10% | 27.73% | ★★★★☆☆ |

| SoftwareONE Holding | 8.06% | 35.51% | ★★★★★☆ |

| Basilea Pharmaceutica | 9.88% | 36.82% | ★★★★★☆ |

| MCH Group | 5.18% | 83.82% | ★★★★☆☆ |

| Sensirion Holding | 13.22% | 80.65% | ★★★★☆☆ |

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★★☆

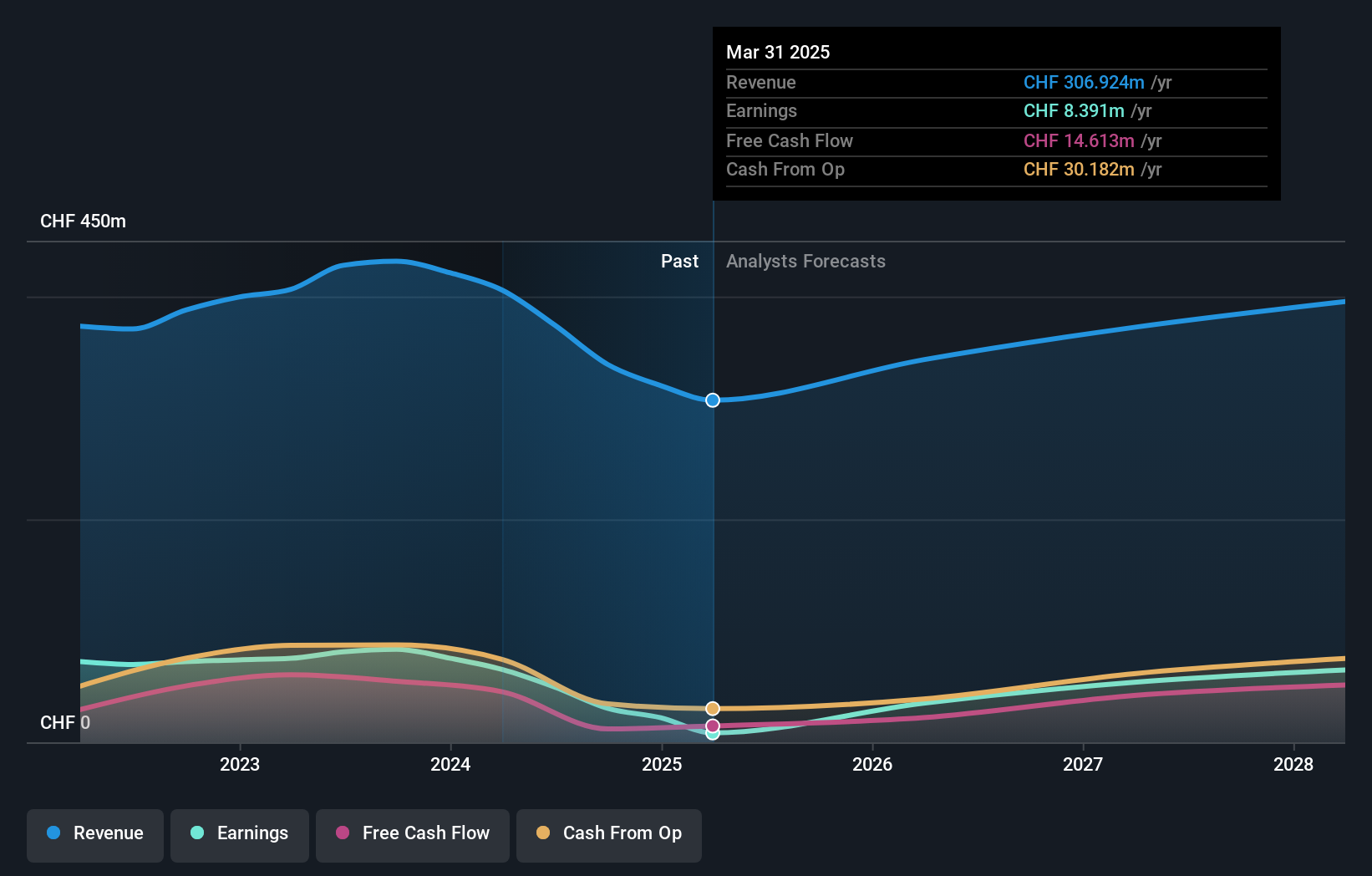

Overview: Comet Holding AG, with a market cap of CHF2.70 billion, provides X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and internationally.

Operations: Comet Holding AG generates revenue primarily from three segments: X-Ray Systems (CHF115.34 million), Industrial X-Ray Modules (CHF95.90 million), and Plasma Control Technologies (CHF180.62 million). The company operates across Europe, North America, Asia, and other international markets.

Comet Holding’s recent earnings report reveals a mixed performance, with sales at CHF 189.32 million, down from CHF 207.03 million the previous year, but net income surged to CHF 4.06 million from CHF 1.94 million. The company’s R&D expenditure is notable; investing heavily in innovation with a focus on AI and semiconductor technologies could position it well for future growth despite current challenges. Earnings are forecasted to grow at an impressive rate of 48.3% annually, significantly outpacing the Swiss market’s average growth of 11.9%.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America and has a market cap of CHF1.42 billion.

Operations: LEM Holding SA specializes in providing electrical parameter measurement solutions across multiple global regions. The company generates revenue through diverse geographical markets, reflecting its extensive international presence.

LEM Holding, a Swiss tech company, has shown mixed financial performance recently. Sales for the first quarter of 2024 were CHF 80.96 million, down from CHF 112.34 million the previous year, while net income dropped to CHF 4.78 million from CHF 20.54 million a year ago. Despite these challenges, LEM’s R&D expenses reflect a strong commitment to innovation; with an investment of CHF 32.5 million in the last fiscal year alone, they are poised for future advancements in AI and semiconductor technologies which could drive growth significantly.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.24 billion.

Operations: Temenos AG specializes in providing integrated banking software systems to financial institutions worldwide. The company’s revenue streams primarily include software licensing, maintenance, and services.

Temenos, a Swiss software firm, is making strategic moves to bolster its SaaS and US market presence. Recent executive appointments aim to drive growth in these areas, supported by a 7.6% annual revenue growth forecast and 14.3% earnings growth projection. R&D expenses of $32 million reflect ongoing innovation efforts. The company repurchased shares worth CHF 110 million this year, signaling confidence in its financial health amidst plans to sell its fund management unit for EUR 600 million.

Summing It All Up

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com