The Switzerland market closed weak on Tuesday as stocks drifted lower after a slightly positive move in early trades, with the benchmark SMI ending down 0.47% at 12,296.72 amid cautious investor sentiment ahead of key economic data from the U.S. In such an environment, identifying high-growth tech stocks that can potentially offer strong returns becomes crucial for investors seeking to navigate market volatility and capitalize on emerging opportunities within Switzerland’s tech sector.

Top 10 High Growth Tech Companies In Switzerland

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

LEM Holding |

9.25% |

18.37% |

★★★★☆☆ |

|

Santhera Pharmaceuticals Holding |

22.30% |

32.48% |

★★★★★★ |

|

Temenos |

7.59% |

14.32% |

★★★★☆☆ |

|

SoftwareONE Holding |

8.71% |

52.46% |

★★★★★☆ |

|

Comet Holding |

19.03% |

48.25% |

★★★★★☆ |

|

Cicor Technologies |

7.10% |

27.73% |

★★★★☆☆ |

|

Basilea Pharmaceutica |

9.88% |

36.82% |

★★★★★☆ |

|

Kudelski |

9.93% |

120.15% |

★★★★☆☆ |

|

Sensirion Holding |

13.96% |

104.68% |

★★★★☆☆ |

|

MCH Group |

5.18% |

83.82% |

★★★★☆☆ |

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★★☆

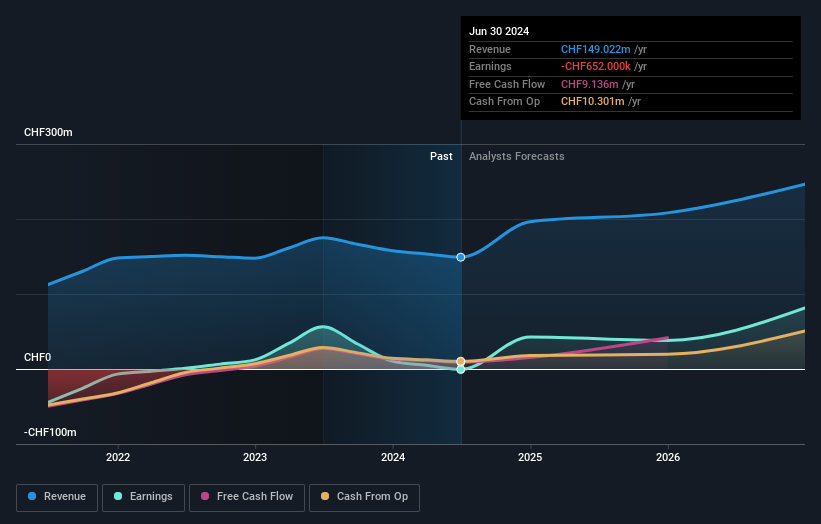

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company specializing in developing products for oncology and anti-infectives, with a market cap of CHF540.60 million.

Operations: Basilea Pharmaceutica AG focuses on the discovery, development, and commercialization of innovative pharmaceutical products in oncology and anti-infectives, generating CHF149.02 million in revenue. The company’s business model centers around addressing unmet medical needs within these therapeutic areas.

Basilea Pharmaceutica has recently achieved a significant milestone with the European Commission extending Cresemba®’s indications to pediatric patients, resulting in a CHF 10 million payment from Pfizer. Despite a 9.9% projected annual revenue growth, recent earnings reports show a decline in net income to CHF 20.74 million from CHF 31.8 million last year. The company’s R&D expenses reflect its commitment to innovation, contributing substantially to future profitability forecasts of 36.82% annual growth over the next three years.

Simply Wall St Growth Rating: ★★★★☆☆

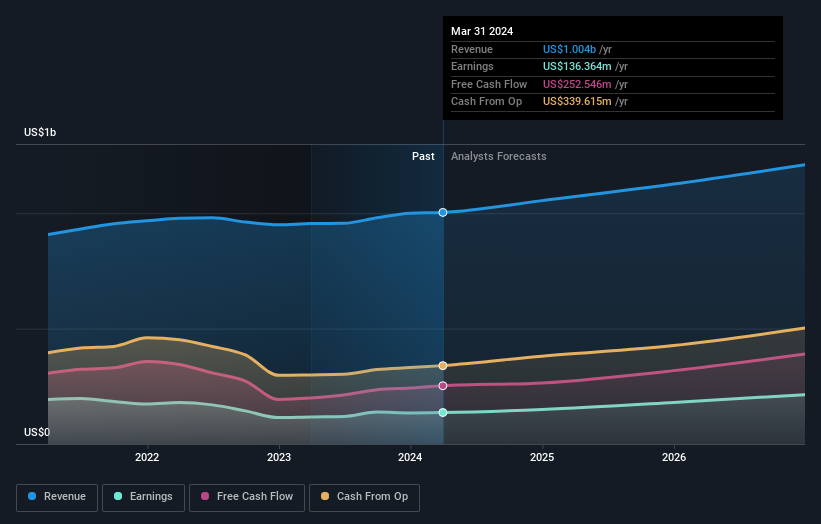

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various global regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America; it has a market cap of CHF1.39 billion.

Operations: LEM Holding SA specializes in providing electrical parameter measurement solutions across various global regions. The company generates revenue primarily through the sale of these measurement solutions, with significant contributions from markets in Asia, Europe, and the Americas.

LEM Holding’s recent performance has been mixed, with first-quarter sales dropping to CHF 80.96 million from CHF 112.34 million a year ago and net income declining to CHF 4.78 million from CHF 20.54 million. Despite these challenges, the company is poised for future growth with an expected annual earnings increase of 18.4%, outpacing the Swiss market’s average of 11.9%. Notably, LEM Holding invests significantly in R&D, spending CHF 40 million last year to drive innovation in their electronic components segment.

Simply Wall St Growth Rating: ★★★★☆☆

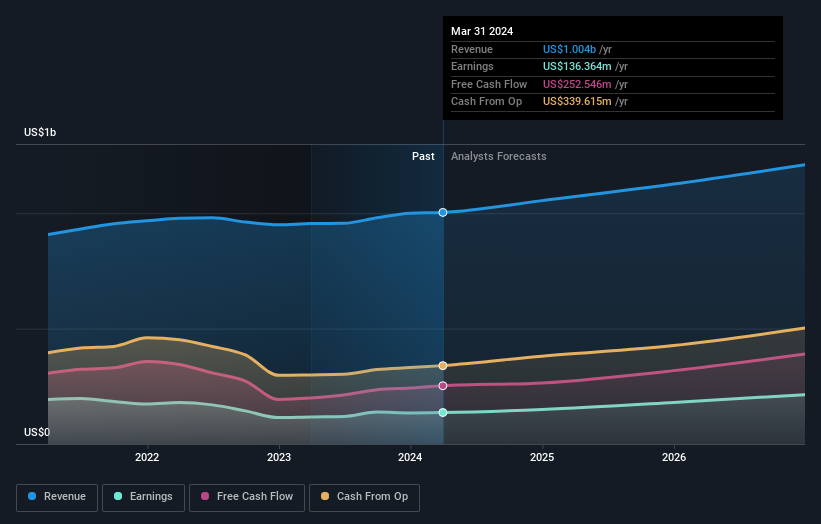

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.26 billion.

Operations: The company generates revenue by providing integrated banking software systems to financial institutions worldwide. With a market cap of CHF4.26 billion, its primary revenue streams include software licensing, maintenance fees, and professional services.

Temenos is leveraging its strong SaaS capabilities to drive growth, as evidenced by Haventree Bank’s recent selection of Temenos for digital transformation. The company’s R&D expenses highlight its commitment to innovation, with CHF 40 million spent last year. Revenue forecasts show a steady annual growth rate of 7.6%, outpacing the Swiss market’s 4.4%. Earnings are expected to grow at an impressive 14.3% per year, reflecting robust financial health and strategic positioning in the software industry.

Key Takeaways

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BSLN SWX:LEHN and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com