After opening weak and struggling for support till a little past noon, the Switzerland market emerged higher on Wednesday, but retreated soon and eventually ended the day’s session on a negative note. Uncertainty about the size of U.S. interest rate cut, and persisting concerns about the outlook for global economic growth weighed on stocks. The benchmark SMI ended down 41.80 points or 0.35% at 11,922.91. In this fluctuating market environment, identifying high-growth tech stocks can be crucial for investors seeking robust returns amidst volatility; Basilea Pharmaceutica is one such Swiss company that stands out in this sector due to its innovative approach and strong growth potential.

Top 10 High Growth Tech Companies In Switzerland

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

LEM Holding |

9.02% |

17.07% |

★★★★☆☆ |

|

ALSO Holding |

11.99% |

23.95% |

★★★★☆☆ |

|

Santhera Pharmaceuticals Holding |

22.30% |

32.48% |

★★★★★★ |

|

Comet Holding |

21.67% |

48.51% |

★★★★★★ |

|

Temenos |

7.59% |

14.32% |

★★★★☆☆ |

|

Cicor Technologies |

7.10% |

27.73% |

★★★★☆☆ |

|

SoftwareONE Holding |

8.60% |

52.57% |

★★★★★☆ |

|

Basilea Pharmaceutica |

8.99% |

36.39% |

★★★★★☆ |

|

Sensirion Holding |

13.96% |

104.68% |

★★★★☆☆ |

|

Kudelski |

9.93% |

120.15% |

★★★★☆☆ |

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★★☆

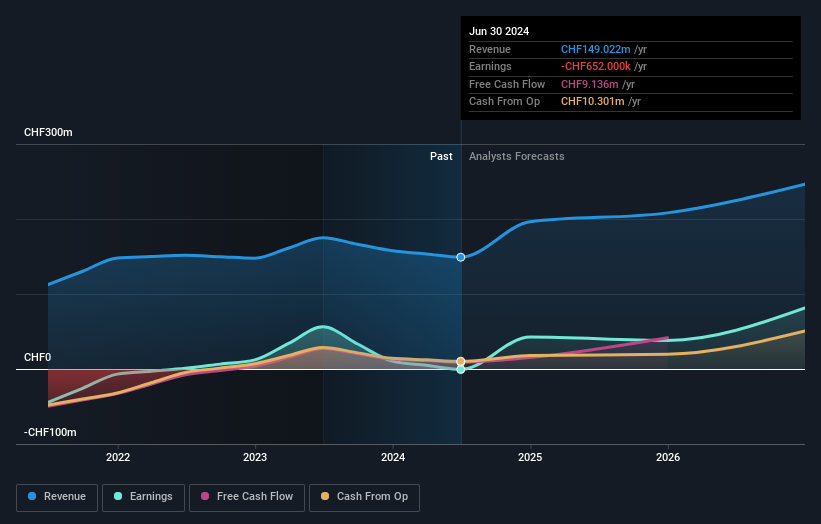

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company specializing in developing products for oncology and anti-infectives, with a market cap of CHF553.33 million.

Operations: The company’s primary revenue stream comes from the discovery, development, and commercialization of innovative pharmaceutical products, generating CHF149.02 million. Basilea Pharmaceutica AG focuses on addressing medical needs in oncology and anti-infectives.

Basilea Pharmaceutica’s revenue is forecast to grow at 9% annually, outpacing the Swiss market’s 4.5% growth rate. Despite current unprofitability, earnings are expected to surge by 36.39% per year over the next three years, with a projected Return on Equity reaching an impressive 83.8%. The company’s recent milestone includes a CHF 10 million payment from Pfizer due to extended market exclusivity for Cresemba® in pediatric patients, highlighting its innovative contributions in antifungal treatments.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, Middle East, Africa, NAFTA and Latin America and has a market cap of CHF1.42 billion.

Operations: LEM Holding SA generates revenue by providing electrical parameter measurement solutions across multiple global regions. The company’s cost structure and financial performance data are not detailed in the provided text.

LEM Holding’s revenue is forecast to grow 9% annually, outpacing the Swiss market’s 4.5% growth rate. Despite a challenging year with Q1 sales dropping to CHF 80.96 million from CHF 112.34 million, the company anticipates earnings growth of 17.1% per year and a robust Return on Equity of 34.6%. With R&D expenses contributing significantly to innovation, LEM Holding continues to invest strategically in technology advancements within the electronics sector, ensuring future competitiveness and potential market leadership.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally and has a market cap of CHF4.33 billion.

Operations: The company generates revenue by providing integrated banking software systems to financial institutions worldwide. Key revenue streams include licensing, software-as-a-service (SaaS), and maintenance fees.

Temenos, a leader in banking software, is forecast to grow its revenue by 7.6% annually and earnings by 14.3% per year, outpacing the Swiss market’s growth rates. The company has made significant strides in SaaS adoption, partnering with clients like Haventree Bank to enhance digital transformation efforts. Recent executive appointments aim to bolster their market position in the US and SaaS sectors. Notably, Temenos repurchased 3,263,937 shares for CHF 200 million between May and August 2024.

Seize The Opportunity

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BSLN SWX:LEHN and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com