The Financials sector in Switzerland gained 3.3% while the market remained flat over the last week, and overall, the market has risen 6.1% in the past 12 months with earnings expected to grow by 12% per annum over the next few years. In this favorable environment, identifying high growth tech stocks like ALSO Holding can be crucial for investors looking to capitalize on promising opportunities in a thriving sector.

Top 10 High Growth Tech Companies In Switzerland

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

LEM Holding |

8.69% |

18.43% |

★★★★☆☆ |

|

Santhera Pharmaceuticals Holding |

26.80% |

35.40% |

★★★★★★ |

|

ALSO Holding |

11.99% |

23.95% |

★★★★☆☆ |

|

Comet Holding |

21.22% |

47.97% |

★★★★★★ |

|

Temenos |

7.60% |

14.32% |

★★★★☆☆ |

|

SoftwareONE Holding |

8.60% |

52.57% |

★★★★★☆ |

|

Cicor Technologies |

7.10% |

27.73% |

★★★★☆☆ |

|

Basilea Pharmaceutica |

8.99% |

36.39% |

★★★★★☆ |

|

Sensirion Holding |

13.96% |

104.68% |

★★★★☆☆ |

|

Kudelski |

12.23% |

121.75% |

★★★★☆☆ |

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ALSO Holding AG operates as a technology services provider for the ICT industry in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF3.27 billion.

Operations: ALSO Holding AG generates revenue primarily from its operations in Central Europe (€4.62 billion) and Northern/Eastern Europe (€5.24 billion). The company serves the ICT industry across multiple countries, leveraging its extensive regional presence to drive sales.

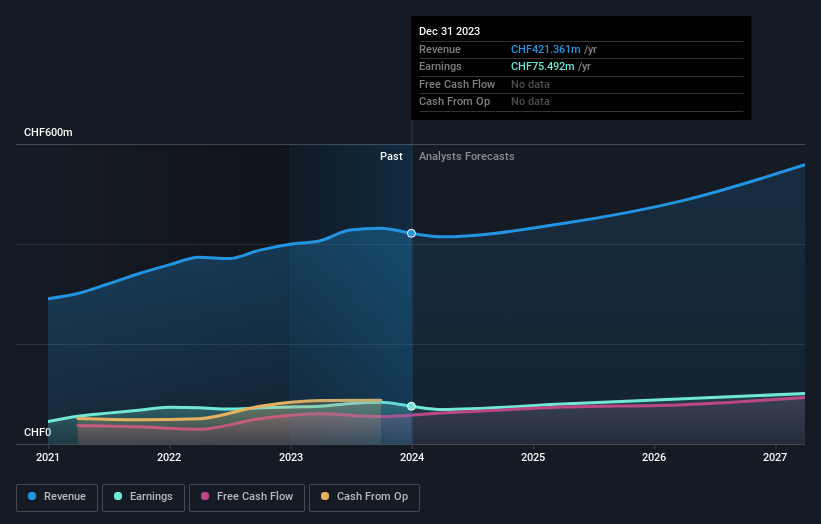

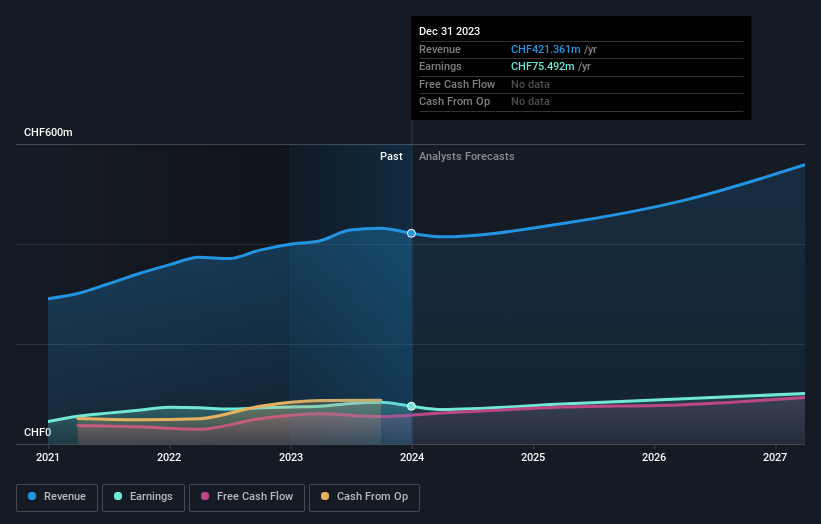

ALSO Holding AG’s revenue for the half year ended June 30, 2024, was €4.28 billion, down from €4.83 billion a year ago. Despite this drop, earnings are forecast to grow at an impressive 24% per year compared to the Swiss market’s 11.7%. The company’s R&D expenses have remained consistent, contributing significantly to its technological advancements and future growth potential. Earnings per share fell from €4.24 to €3.40, reflecting a challenging period but also highlighting resilience in a volatile market environment. The company repurchased shares in the past year, indicating confidence in its long-term prospects despite recent earnings volatility (-20.4%). ALSO Holding operates within an industry increasingly shifting towards SaaS models and recurring revenue streams from subscriptions—an area where it continues investing heavily in R&D (€41 million). This strategic focus on innovation positions it well for capturing future opportunities within the tech sector while navigating current market challenges effectively.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America and has a market cap of CHF1.48 billion.

Operations: LEM Holding SA specializes in providing electrical parameter measurement solutions across multiple regions globally. The company operates through distinct revenue segments, generating significant income from its diverse geographic markets.

LEM Holding, a Swiss tech firm specializing in electrical measurement solutions, has demonstrated notable resilience despite recent challenges. The company’s earnings are forecast to grow at 18.4% per year, outpacing the Swiss market’s 11.7%. However, its net profit margin dropped from 19% to 13.2%, reflecting a challenging period with Q1 sales falling to CHF 80.96 million from CHF 112.34 million last year. LEM’s strong focus on R&D is evident with significant investments aimed at sustaining innovation and growth within the industry.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.38 billion.

Operations: Temenos AG generates revenue primarily through product sales ($879.99 million) and services ($132.98 million). The company’s focus is on providing integrated banking software systems to financial institutions worldwide.

Temenos, a leading software firm in Switzerland, is experiencing steady growth with earnings expected to rise 14.3% annually and revenue projected to grow at 7.6% per year, outpacing the Swiss market’s 4.5%. The company’s strategic focus on SaaS models ensures recurring revenue from subscriptions, enhancing business stability. Recent executive appointments aim to bolster its market position in the US and SaaS segments. Significant R&D investments underscore Temenos’ commitment to innovation and long-term growth within the industry.

Make It Happen

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:ALSN SWX:LEHN and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com