In the last week, the Swiss market has stayed flat, but it has risen 6.1% over the past 12 months with earnings forecasted to grow by 12% annually. In this context, identifying promising stocks that combine strong fundamentals with growth potential becomes crucial for investors looking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Value Rating: ★★★★☆☆

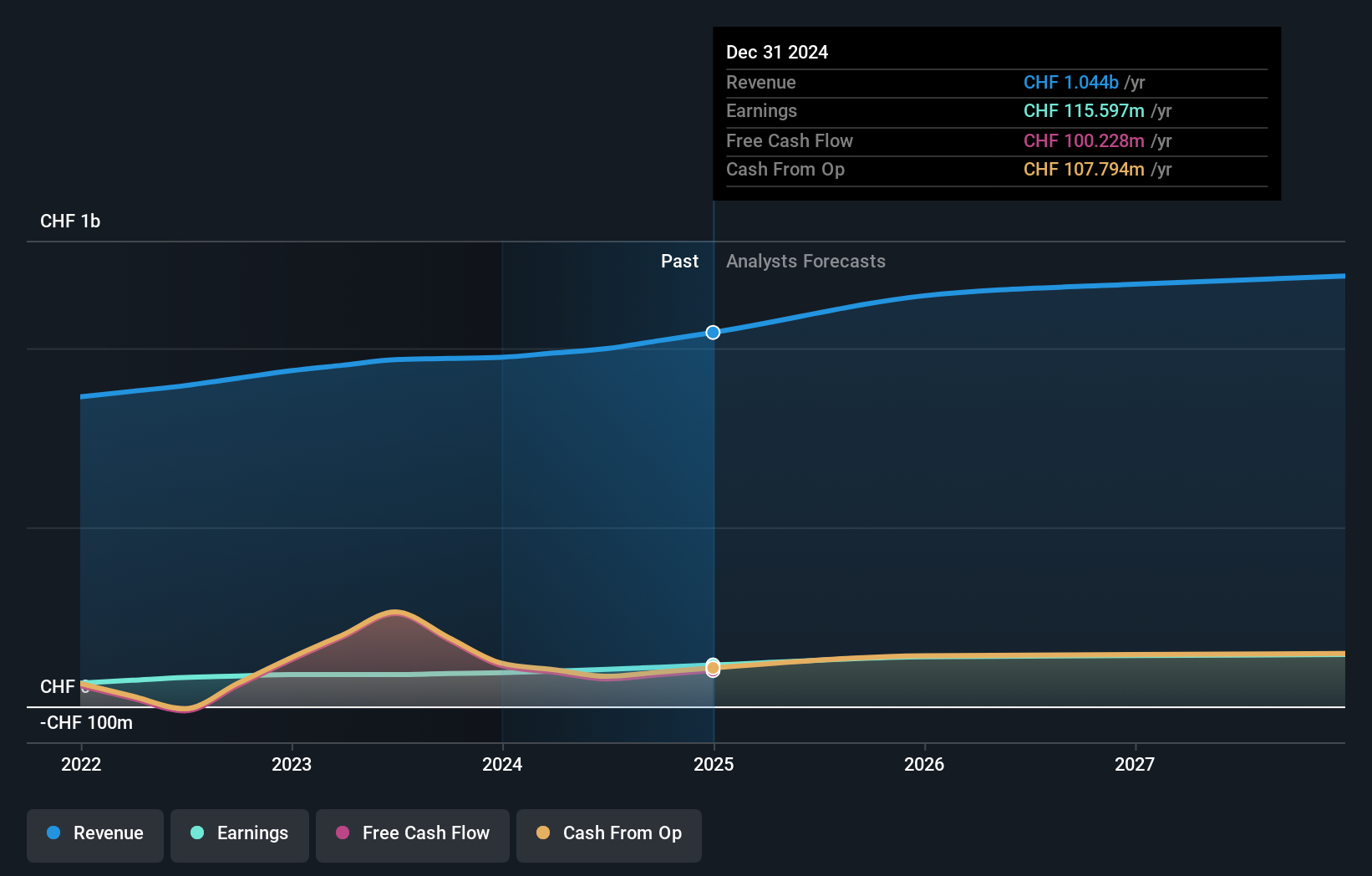

Overview: Burkhalter Holding AG, with a market cap of CHF941.54 million, operates through its subsidiaries to provide electrical engineering services to the construction sector in Switzerland.

Operations: Burkhalter Holding AG generates revenue primarily from its electrical engineering services, totaling CHF1.18 billion. The company’s cost structure and profit margins are not detailed in the provided information.

Burkhalter Holding, a notable player in Switzerland’s construction industry, reported CHF 570.3 million revenue for the half year ending June 30, 2024, up from CHF 529.27 million last year. Net income rose to CHF 23.3 million from CHF 21.21 million, with earnings per share at CHF 2.19 compared to CHF 2.04 previously. The company’s debt-to-equity ratio surged from 17.4% to 89.5% over five years while maintaining a high net debt-to-equity ratio of approximately 52%.

Simply Wall St Value Rating: ★★★★★☆

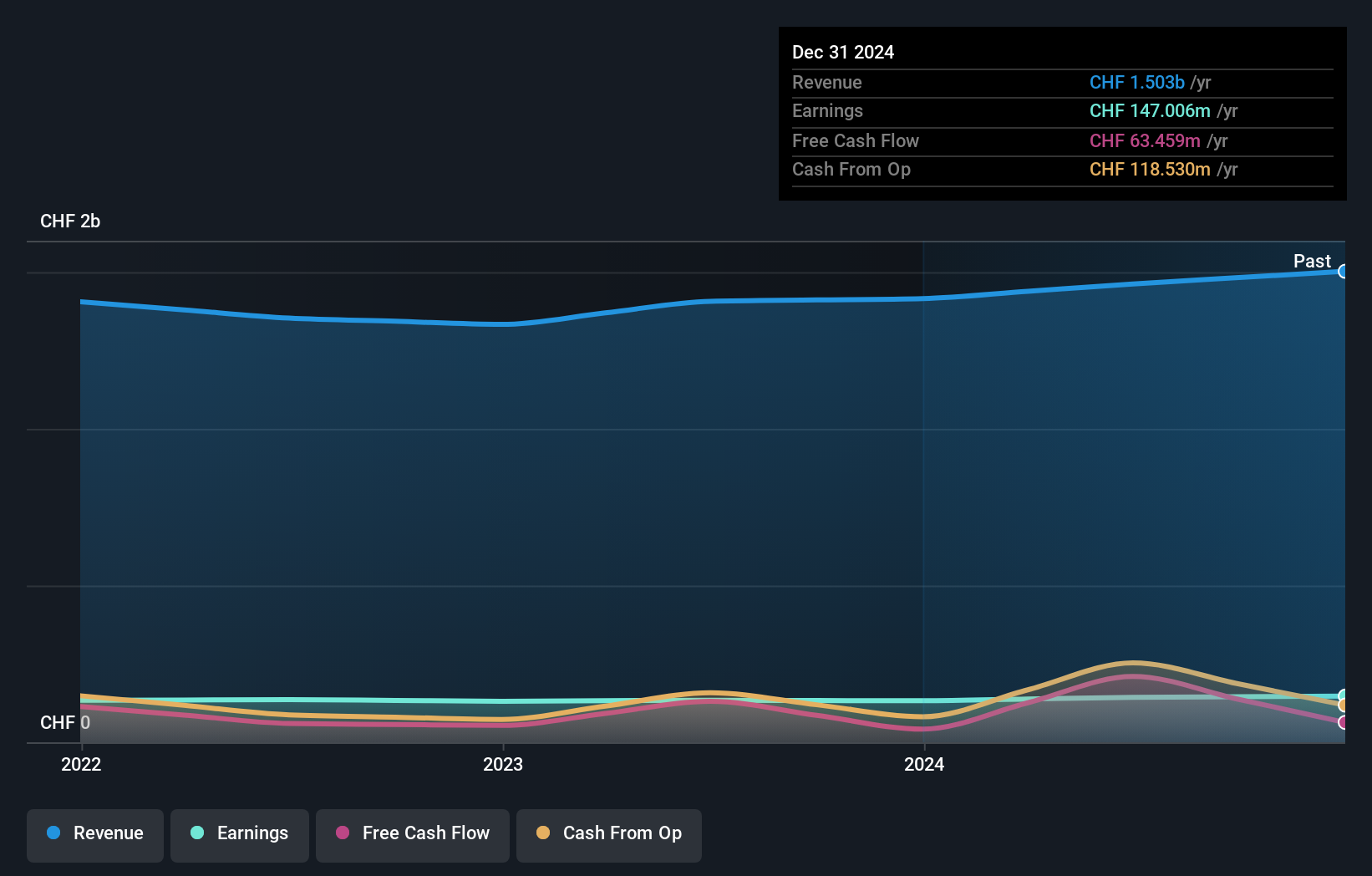

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market cap of CHF1.20 billion.

Operations: Compagnie Financière Tradition SA generates revenue primarily from three geographic segments: Americas (CHF352.67 million), Asia-Pacific (CHF273.16 million), and Europe, Middle East and Africa (CHF452.85 million).

Compagnie Financière Tradition (CFT) has shown robust performance with earnings growing 16.1% over the past year, outpacing the Capital Markets industry’s -12.1%. Trading at 32.2% below estimated fair value, CFT appears undervalued. Over five years, its debt to equity ratio improved from 75.7% to 47.1%. Recent results for H1 2024 reported revenue of CHF 538 million and net income of CHF 60 million, up from CHF 514 million and CHF 51 million respectively a year ago.

Simply Wall St Value Rating: ★★★★★☆

Overview: Vaudoise Assurances Holding SA offers a range of insurance products and services primarily in Switzerland, with a market cap of CHF1.35 billion.

Operations: Vaudoise Assurances Holding SA generates revenue through its insurance products and services in Switzerland. The company has a market cap of CHF1.35 billion.

Vaudoise Assurances Holding, a Swiss insurance entity, has shown promising growth with earnings increasing by 7.1% over the past year, surpassing the industry average of 6.7%. The firm trades at 65% below its estimated fair value and remains debt-free, enhancing its financial stability. Recent half-year results reported net income of CHF 81.17 million compared to CHF 70.02 million last year, indicating robust performance and potential for future growth in the insurance sector.

Where To Now?

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Burkhalter Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com