The Swiss market recently exhibited a mixed performance, with the benchmark SMI index experiencing fluctuations and closing slightly lower, while some companies like Relief Therapeutics saw significant gains. In this dynamic environment, identifying high-growth tech stocks in Switzerland can be a strategic move for investors seeking to enhance their portfolios by capitalizing on innovation and resilience amidst market volatility.

Top 10 High Growth Tech Companies In Switzerland

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

LEM Holding |

8.81% |

20.48% |

★★★★★☆ |

|

Santhera Pharmaceuticals Holding |

26.80% |

35.40% |

★★★★★★ |

|

ALSO Holding |

12.58% |

26.76% |

★★★★☆☆ |

|

Comet Holding |

20.06% |

48.34% |

★★★★★★ |

|

Temenos |

7.58% |

14.39% |

★★★★☆☆ |

|

SoftwareONE Holding |

8.55% |

52.33% |

★★★★★☆ |

|

Addex Therapeutics |

26.51% |

33.31% |

★★★★★☆ |

|

Basilea Pharmaceutica |

9.24% |

33.25% |

★★★★★☆ |

|

Sensirion Holding |

13.86% |

102.68% |

★★★★☆☆ |

|

MCH Group |

4.41% |

100.62% |

★★★★☆☆ |

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★★☆

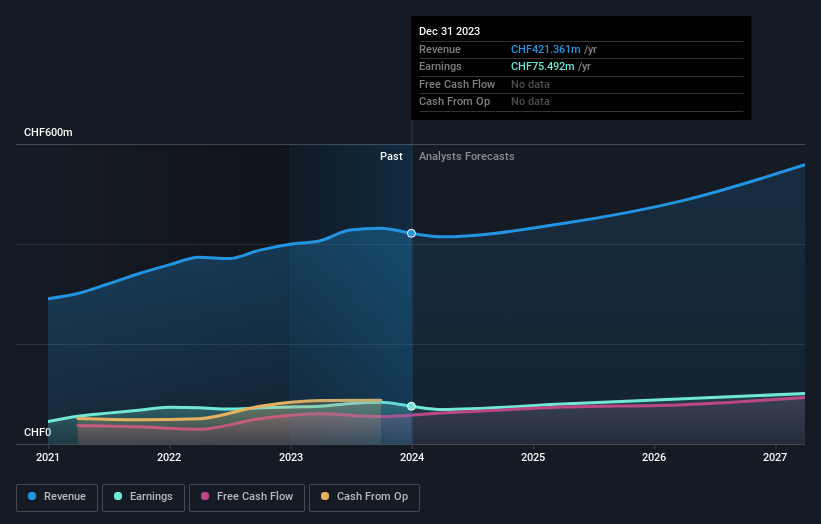

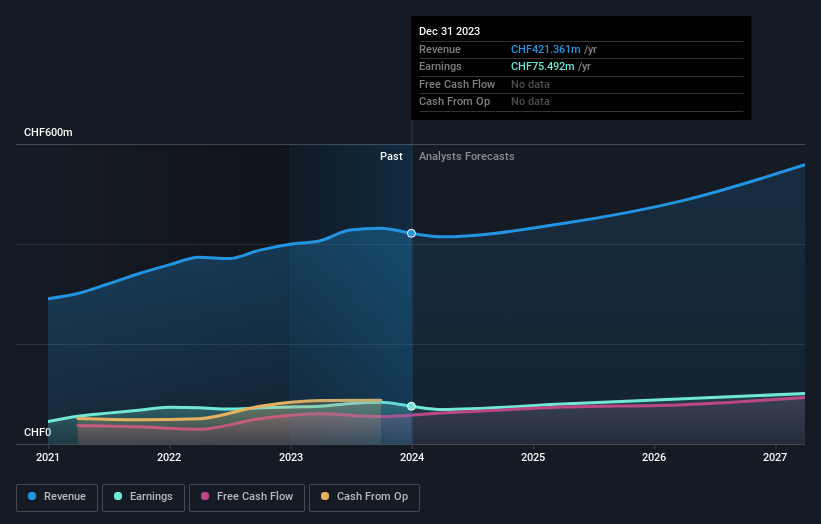

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company that develops products for oncology and anti-infectives, with a market cap of CHF545.45 million.

Operations: The company generates revenue primarily from the discovery, development, and commercialization of innovative pharmaceutical products, amounting to CHF149.02 million. Its focus is on addressing medical needs in oncology and anti-infectives.

Basilea Pharmaceutica, a Swiss biotech firm, recently raised its 2024 revenue and profit forecasts to CHF 203 million and CHF 60 million respectively, signaling robust business growth. This upward revision follows significant regulatory advancements such as the extended EC approval of Cresemba® for pediatric use, enhancing its market exclusivity until October 2027—a move that also secured a CHF 10 million milestone payment from Pfizer. Despite a dip in mid-year revenues to CHF 76.29 million from CHF 84.91 million the previous year, Basilea’s strategic focus on expanding indications for its flagship products positions it well within the high-growth tech sector in Switzerland. The company’s commitment to R&D is evident with an expected sharp increase in profitability over the next three years and revenue growth projected at an annual rate of 9.2%, outpacing the broader Swiss market’s growth rate of 4.2%.

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, specializes in providing solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America and has a market cap of CHF1.41 billion.

Operations: The company focuses on delivering electrical measurement solutions globally, with significant operations spanning Asia, Europe, and the Americas. It operates in a market valued at CHF1.41 billion.

LEM Holding, despite a challenging quarter with sales dropping to CHF 80.96 million from CHF 112.34 million and net income falling to CHF 4.78 million from CHF 20.54 million, is positioned for recovery with expected earnings growth of 20.5% annually, surpassing the Swiss market’s forecast of 11.6%. This resilience is underpinned by a robust R&D focus, crucial for maintaining competitive edge in Switzerland’s tech landscape where innovation drives success. The firm’s strategic emphasis on R&D investment aligns with its anticipated revenue growth of 8.8% per year—double the national average of 4.2%, showcasing its potential to outperform sectoral trends despite recent setbacks.

Simply Wall St Growth Rating: ★★★★☆☆

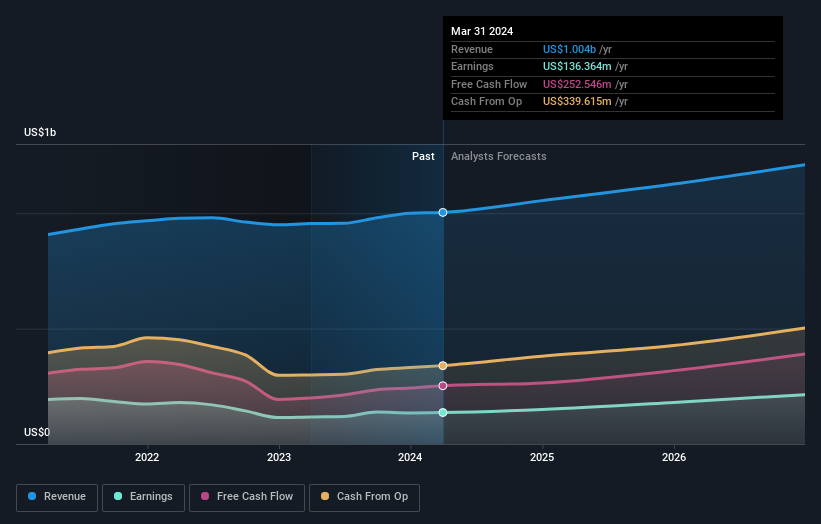

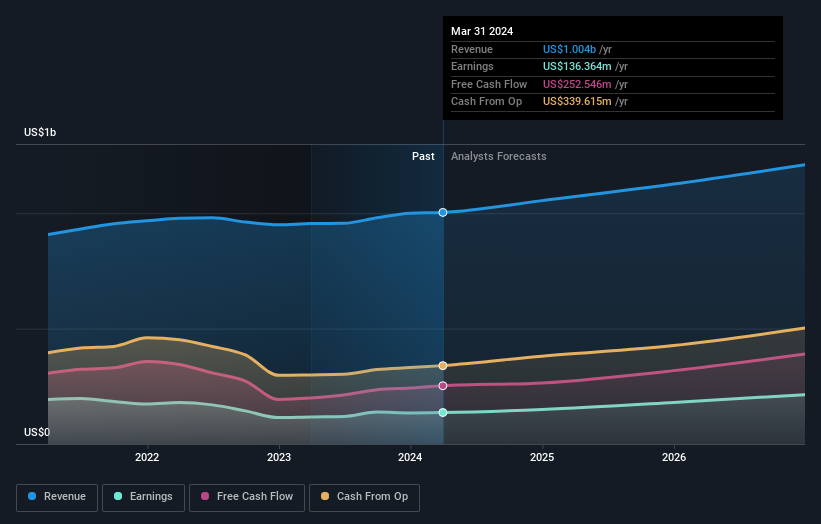

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.65 billion.

Operations: The company generates revenue primarily through its Product segment, which accounts for approximately $880 million, and its Services segment, contributing around $133 million.

Temenos, a Swiss tech firm, is poised for robust growth with earnings forecasted to rise by 14.4% annually, outpacing the local market’s 11.6%. This growth trajectory is supported by a significant commitment to R&D, which not only fuels innovation but also enhances competitive advantage in the rapidly evolving software industry. Recent strategic hires and leadership changes underscore Temenos’s focus on integrating AI and cloud technologies to expand its global footprint and meet diverse financial sector needs effectively. Additionally, the company has actively repurchased shares worth CHF 200 million between May and August 2024, reflecting confidence in its financial health and future prospects.

Turning Ideas Into Actions

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BSLN SWX:LEHN and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com