The Swiss market has shown a positive trend, rising 1.1% over the last week and gaining 10% in the past year, with earnings anticipated to grow by 12% annually in the coming years. In this context, identifying high growth tech stocks involves looking for companies that not only align with these upward trends but also demonstrate strong potential for sustained innovation and expansion.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 8.69% | 18.43% | ★★★★☆☆ |

| Santhera Pharmaceuticals Holding | 24.55% | 35.40% | ★★★★★★ |

| ALSO Holding | 12.58% | 26.76% | ★★★★☆☆ |

| Comet Holding | 19.66% | 47.84% | ★★★★★☆ |

| SoftwareONE Holding | 8.59% | 52.33% | ★★★★★☆ |

| Cicor Technologies | 7.59% | 27.14% | ★★★★☆☆ |

| Addex Therapeutics | 26.51% | 33.31% | ★★★★★☆ |

| Basilea Pharmaceutica | 9.24% | 33.25% | ★★★★★☆ |

| MCH Group | 4.41% | 100.62% | ★★★★☆☆ |

| Sensirion Holding | 13.86% | 102.68% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ALSO Holding AG is a technology services provider for the ICT industry operating in Switzerland, Germany, the Netherlands, Poland, and internationally, with a market cap of CHF3.20 billion.

Operations: The company generates revenue primarily from its operations in Central Europe and Northern/Eastern Europe, with figures of €4.62 billion and €5.24 billion, respectively.

ALSO Holding, navigating through the competitive tech landscape in Switzerland, reported a dip in sales to EUR 4.28 billion and net income to EUR 41.66 million for the first half of 2024, reflecting challenges yet underscoring resilience given broader market conditions. Despite these figures, the company’s R&D investment remains robust, aligning with its commitment to innovation and maintaining a competitive edge in high-growth sectors like cloud computing and cybersecurity solutions. With an expected annual profit growth of 26.8%, ALSO is poised above many Swiss peers, suggesting potential for rebound and market share gains especially as it leverages recent technological advancements presented at significant industry events like the Baader Investment Conference.

The company’s strategic focus on expanding its software services portfolio is evident from its R&D spending trends which are crucial for sustaining long-term growth amidst evolving digital demands. Revenue forecasts show a promising increase of 12.6% per year, outpacing the average market growth rate in Switzerland by a considerable margin. This positions ALSO uniquely within an industry where innovation cycles are rapidly shortening and client expectations are continuously escalating. Looking ahead, while current earnings reflect past pressures, the consistent investment in technology development could drive future profitability and enhance shareholder value as market conditions improve.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company that develops products targeting oncology and anti-infective therapeutic areas, with a market cap of CHF553.33 million.

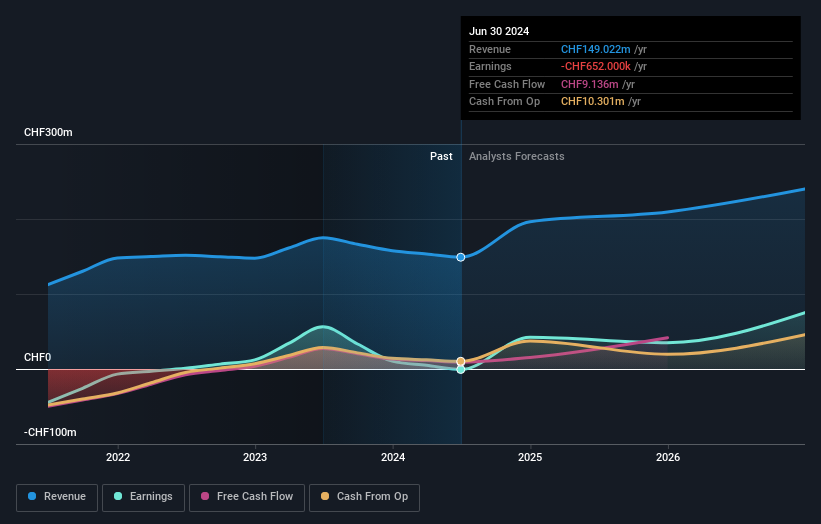

Operations: Basilea Pharmaceutica AG focuses on the discovery, development, and commercialization of innovative pharmaceutical products within oncology and anti-infective sectors, generating CHF149.02 million in revenue. The company’s business model is centered around addressing unmet medical needs through its specialized product offerings.

Basilea Pharmaceutica, amidst a dynamic Swiss tech landscape, has recently updated its 2024 financial outlook, now expecting CHF 203 million in revenue and a net profit of CHF 60 million. This revision reflects a significant uptick from earlier projections (CHF 190 million in revenue and CHF 42 million in net profit), underpinned by strategic advances including the expanded EC approval of its antifungal Cresemba® for pediatric use. This approval not only broadens the treatment’s market but also extends its exclusivity until October 2027, enhancing Basilea’s competitive stance. Furthermore, with R&D expenditures maintaining a healthy ratio to revenue at around 9.2%, Basilea is investing robustly in innovation—critical for sustaining growth in the biotech sector where rapid advancements are commonplace. These efforts are anticipated to propel earnings growth by an impressive annual rate of approximately 33.2%, showcasing Basilea’s potential to outperform within its industry.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.65 billion.

Operations: Temenos generates revenue primarily through its Product segment, accounting for $879.99 million, and its Services segment, contributing $132.98 million.

Temenos, a leader in banking software solutions, is strategically enhancing its market position through significant leadership changes and share buybacks. Recently appointing Barb Morgan as Chief Product and Technology Officer, the company underscores its commitment to integrating advanced AI technologies into its offerings. This move aligns with Temenos’s focus on cloud-based platforms and AI-driven solutions tailored for global financial institutions. Notably, from May to August 2024, Temenos repurchased shares worth CHF 200 million, reflecting confidence in its strategic direction. Moreover, with R&D expenses representing 14.4% of revenue—a substantial investment—Temenos is poised to maintain technological leadership in the competitive banking software sector. These developments are set against a backdrop of robust projected earnings growth at 14.36% annually and revenue forecasts growing at 7.6% per year, outpacing the broader Swiss market trends.

Seize The Opportunity

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Basilea Pharmaceutica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com