The Swiss market recently experienced a modest downturn, influenced by rising U.S. consumer price inflation and an increase in initial jobless claims, which weighed on investor sentiment and led to a slight decline in the SMI index. In this climate of cautious optimism, identifying high-growth tech stocks involves looking for companies with strong fundamentals and innovative capabilities that can navigate economic challenges while capitalizing on emerging opportunities within the tech sector.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 8.69% | 18.43% | ★★★★☆☆ |

| Santhera Pharmaceuticals Holding | 24.55% | 35.40% | ★★★★★★ |

| ALSO Holding | 12.58% | 26.76% | ★★★★☆☆ |

| Comet Holding | 19.66% | 47.84% | ★★★★★☆ |

| SoftwareONE Holding | 8.59% | 52.33% | ★★★★★☆ |

| Cicor Technologies | 7.10% | 27.73% | ★★★★☆☆ |

| Addex Therapeutics | 26.51% | 33.31% | ★★★★★☆ |

| Basilea Pharmaceutica | 9.24% | 33.25% | ★★★★★☆ |

| MCH Group | 4.41% | 100.62% | ★★★★☆☆ |

| Sensirion Holding | 13.86% | 102.68% | ★★★★☆☆ |

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ALSO Holding AG is a technology services provider for the ICT industry operating in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF3.23 billion.

Operations: The company generates revenue primarily from its operations in Central Europe (€4.62 billion) and Northern/Eastern Europe (€5.24 billion).

ALSO Holding’s recent performance and projections paint a mixed picture of its growth trajectory within the high-tech sector in Switzerland. Despite a challenging past year with earnings declining by 20.4%, the company is set for a robust recovery with forecasted annual earnings growth of 26.8%. This rebound is notably higher than the broader Swiss market’s expectation of 11.6%. At the Baader Investment Conference, ALSO highlighted strategic initiatives likely to drive this growth, yet it wrestles with a highly volatile share price and lower sales compared to last year—EUR 4.28 billion from EUR 4.83 billion previously.

The firm’s commitment to innovation is evident from its R&D spending trends, which align closely with its future revenue prospects that are expected to grow at an annual rate of 12.6%. While this figure trails behind some industry benchmarks for high-growth tech firms, it still outpaces general market growth in Switzerland (4.3%). ALSO’s focus on enhancing operational efficiencies and expanding market reach through strategic conferences could bolster its position in upcoming years despite current financial pressures and an increasingly competitive landscape.

Simply Wall St Growth Rating: ★★★★★☆

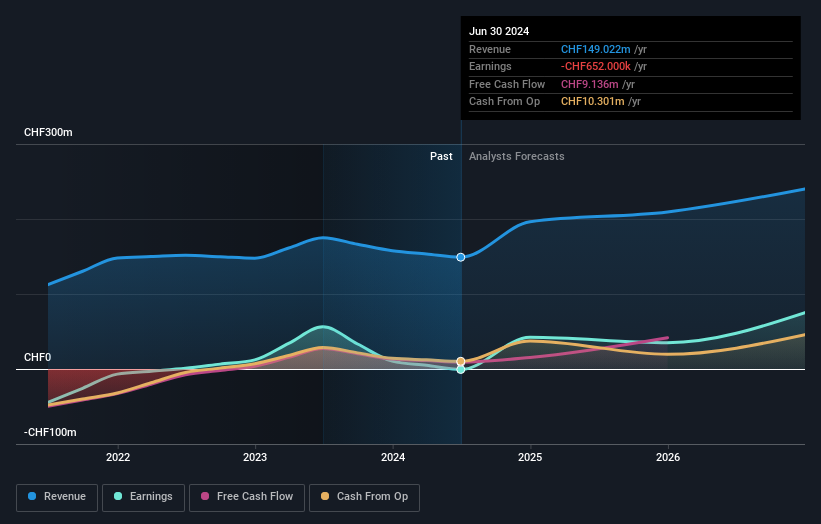

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company specializing in developing oncology and anti-infective products, with a market cap of CHF550.30 million.

Operations: The company generates revenue primarily through the discovery, development, and commercialization of innovative pharmaceutical products, totaling CHF149.02 million. Its focus on oncology and anti-infectives forms the core of its business operations.

Basilea Pharmaceutica, navigating through a challenging biotech landscape, has demonstrated resilience with a projected revenue growth of 9.2% annually, outpacing the broader Swiss market’s 4.3%. This growth is underpinned by recent strategic wins such as the extended EC approval for Cresemba® and an enhanced financial outlook for 2024, expecting CHF 203 million in revenue and CHF 60 million in net profit. Despite current unprofitability, Basilea’s R&D commitment is robust, aligning with its forward-looking revenue projections and an impressive anticipated return on equity of 83.8% in three years. These developments suggest a strategic positioning to leverage upcoming market opportunities effectively.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a company that develops, markets, and sells integrated banking software systems to financial institutions globally, with a market capitalization of CHF4.59 billion.

Operations: Temenos generates revenue primarily from its Product segment, contributing $879.99 million, and a smaller portion from Services at $132.98 million.

Temenos, a Swiss tech firm, is navigating the competitive landscape of financial software with a notable focus on R&D, dedicating 14.4% of its revenue to this segment. This investment fuels innovations that are crucial for staying ahead in the rapidly evolving banking technology sector. Recent strategic executive appointments and an aggressive share buyback program (repurchasing shares worth CHF 200 million) underscore its commitment to growth and market expansion. With revenues growing at 7.6% annually—outpacing the broader Swiss market’s growth—Temenos is poised to leverage its enhanced capabilities and robust financial strategy to meet the future demands of global financial institutions effectively.

Seize The Opportunity

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com