The Switzerland market shrugged off early weakness and moved modestly higher on Friday, tracking positive global cues. Investors continued to cheer Swiss National Bank’s interest rate move, in addition to digesting U.S. personal consumption expenditure data. The benchmark SMI ended with a gain of 24.43 points or 0.2% at 12,234.05, reflecting positive sentiment despite mixed performances among individual stocks like SIG Group and SGS. In this context of cautious optimism and favorable economic indicators, identifying high-growth tech stocks becomes crucial for investors looking to capitalize on the momentum within the Swiss market.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Santhera Pharmaceuticals Holding | 26.80% | 35.40% | ★★★★★★ |

| LEM Holding | 8.69% | 18.43% | ★★★★☆☆ |

| ALSO Holding | 12.69% | 24.49% | ★★★★☆☆ |

| Temenos | 7.60% | 14.32% | ★★★★☆☆ |

| Comet Holding | 19.93% | 47.84% | ★★★★★☆ |

| Cicor Technologies | 7.10% | 27.73% | ★★★★☆☆ |

| SoftwareONE Holding | 8.63% | 52.57% | ★★★★★☆ |

| Basilea Pharmaceutica | 9.24% | 34.42% | ★★★★★☆ |

| Kudelski | 13.22% | 121.68% | ★★★★☆☆ |

| Sensirion Holding | 13.76% | 104.68% | ★★★★☆☆ |

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Comet Holding AG, with a market cap of CHF2.62 billion, provides X-ray and radio frequency (RF) power technology solutions through its subsidiaries across Europe, North America, Asia, and internationally.

Operations: Comet Holding AG generates revenue primarily from three segments: X-Ray Systems (CHF115.34 million), Industrial X-Ray Modules (CHF95.90 million), and Plasma Control Technologies (CHF180.62 million). The company focuses on providing advanced X-ray and RF power technology solutions globally through its subsidiaries.

Comet Holding AG’s recent performance and strategic presentations underscore its evolving stance in the tech sector, despite a challenging environment. With a 19.9% annual revenue growth forecast, Comet is pacing ahead of the broader Swiss market’s 4.4% expansion rate, reflecting robust sector-specific demand. The firm also anticipates an impressive 47.8% surge in annual earnings, signaling potential operational efficiencies or market gains. However, it’s crucial to note that while Comet’s net profit margin saw a decrease from last year’s 10.8% to this year’s 4.6%, indicating cost pressures or investment phases that could affect short-term profitability but potentially pave the way for long-term gains as evidenced by their proactive R&D commitments and recent conference showcases aimed at reinforcing industry presence and investor confidence.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG, along with its subsidiaries, develops, produces, sells, and services sensor systems, modules, and components globally with a market cap of CHF1.14 billion.

Operations: Sensirion Holding AG generates revenue primarily from the sale of sensor systems, modules, and components, amounting to CHF237.91 million. The company focuses on developing and producing these products for a global market.

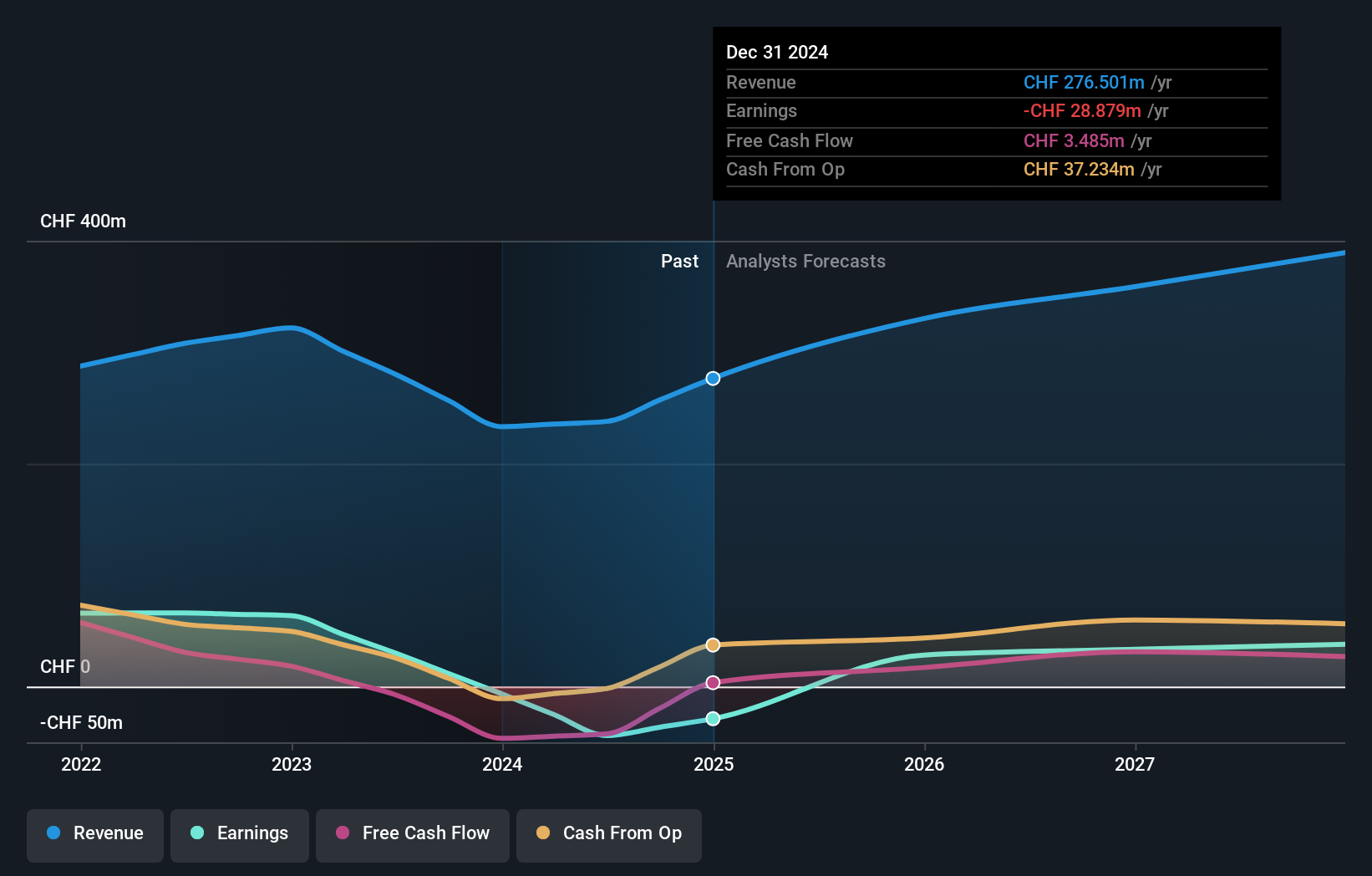

Sensirion Holding AG, despite a recent net loss of CHF 36.01 million from a prior net income of CHF 1.43 million, shows promise with a revenue increase to CHF 127.97 million, up by 3.84% year-over-year. This growth outpaces the broader Swiss market’s projection of 4.4%, highlighting Sensirion’s potential in an expanding sector. The company’s commitment to innovation is evident in its R&D strategy, crucial for reversing the current earnings trend and achieving forecasted profit growth of an impressive 104.7% annually within three years—a stark contrast to its current unprofitability and high share price volatility over the past three months.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally and has a market cap of CHF4.33 billion.

Operations: Temenos AG generates revenue primarily from its product segment ($879.99 million) and services segment ($132.98 million). The company focuses on providing integrated banking software systems to financial institutions worldwide.

Amidst a competitive Swiss tech landscape, Temenos stands out with its strategic focus on R&D and market expansion. In 2024, the firm not only reported a revenue surge to $248.39 million from the previous year but also emphasized its commitment to innovation by investing significantly in research and development, aligning with industry shifts towards SaaS models. This approach is complemented by recent executive hires aimed at bolstering its U.S. market presence and SaaS capabilities, promising enhanced global reach and technological advancements. Moreover, Temenos has actively returned value to shareholders through a substantial buyback program, repurchasing shares worth CHF 200 million, underscoring confidence in its financial health and future prospects. With earnings growth projected at 14.3% annually—outpacing the broader market—Temenos is poised for continued success in high-growth tech sectors.

Where To Now?

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com