The Swiss market recently ended modestly higher, with investors displaying caution amid Middle East tensions and awaiting inflation data for further guidance. In this environment, identifying high-growth tech stocks requires a focus on companies that can navigate economic uncertainties while leveraging innovation to drive future performance.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 8.69% | 18.43% | ★★★★☆☆ |

| Santhera Pharmaceuticals Holding | 24.55% | 35.40% | ★★★★★★ |

| ALSO Holding | 12.69% | 24.49% | ★★★★☆☆ |

| Temenos | 7.60% | 14.36% | ★★★★☆☆ |

| Comet Holding | 19.66% | 47.84% | ★★★★★☆ |

| Cicor Technologies | 7.10% | 27.73% | ★★★★☆☆ |

| SoftwareONE Holding | 8.59% | 52.33% | ★★★★★☆ |

| Basilea Pharmaceutica | 9.24% | 34.42% | ★★★★★☆ |

| Kudelski | 13.22% | 121.68% | ★★★★☆☆ |

| Sensirion Holding | 13.86% | 102.68% | ★★★★☆☆ |

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Comet Holding AG, along with its subsidiaries, offers X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and other international markets, with a market cap of CHF2.51 billion.

Operations: The company generates revenue through three main segments: X-Ray Systems (CHF115.34 million), Industrial X-Ray Modules (CHF95.90 million), and Plasma Control Technologies (CHF180.62 million).

Comet Holding AG, despite a challenging year with a 69.2% dip in earnings, is set to rebound with an anticipated earnings growth of 47.8% annually, outpacing the Swiss market’s forecast of 11.8%. This surge aligns with its revenue projections which are expected to rise by 19.7% yearly, significantly ahead of the broader market’s 4.4%. The firm’s commitment to innovation is evident from its R&D spending trends that robustly support these growth forecasts. Recent presentations at significant industry events like Semicon West and Baader Investment Conference underscore Comet’s active engagement in pivotal technological dialogues, enhancing its industry stature amidst financial recuperation efforts.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG is a company that develops, produces, sells, and services sensor systems, modules, and components globally with a market capitalization of CHF1.12 billion.

Operations: The company focuses on the global market for sensor systems, modules, and components, generating CHF237.91 million in revenue from these segments.

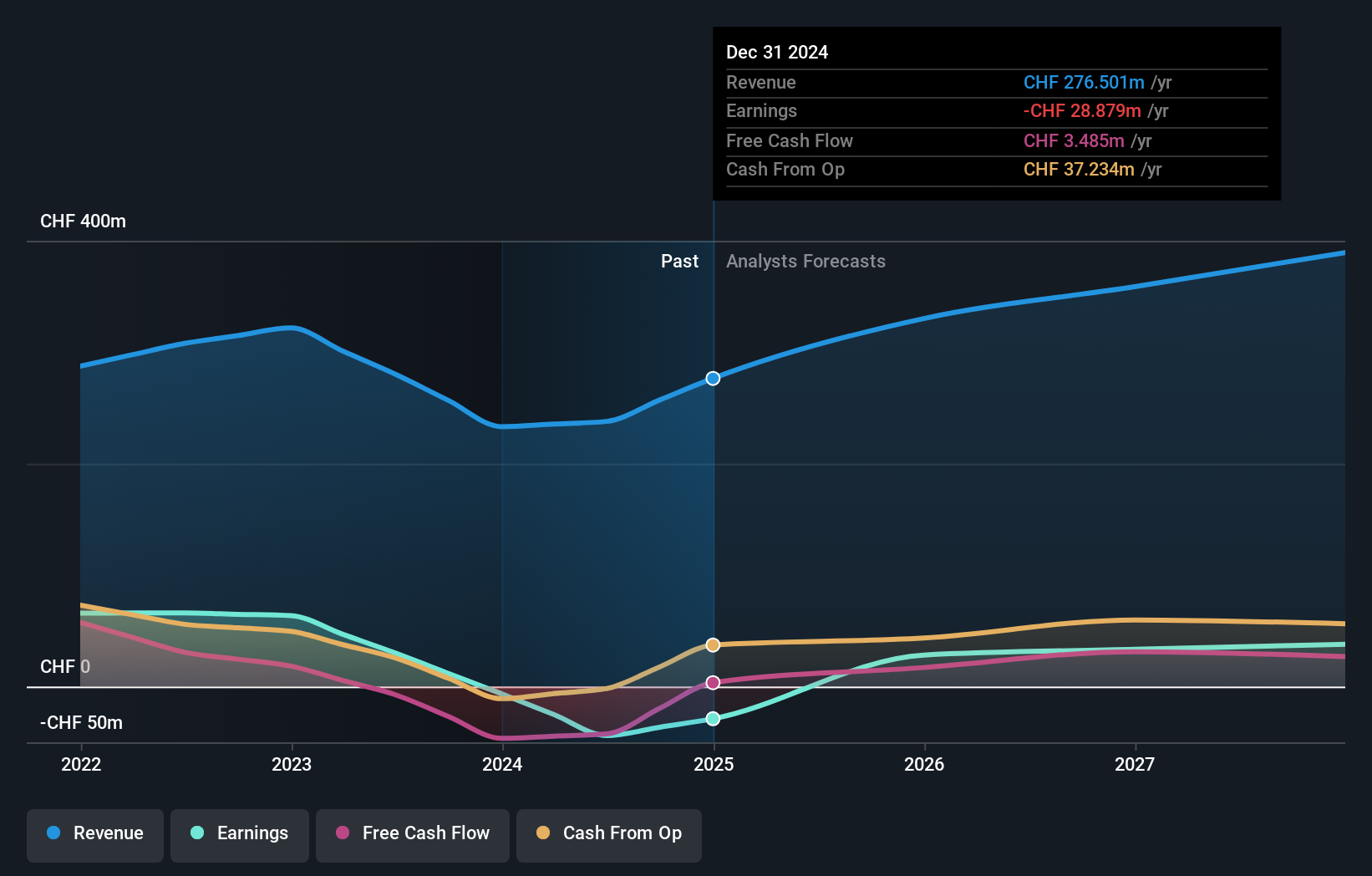

Sensirion Holding AG, amid a challenging landscape with a net loss of CHF 36.01 million this half-year from a profit last year, is poised for recovery with projected earnings growth at an impressive 102.7% annually. This optimism is bolstered by its R&D commitment, which has seen significant investment relative to its revenue, ensuring continuous innovation in its tech offerings. With revenues expected to outpace the Swiss market’s growth at 13.9% per year compared to the broader market’s 4.4%, Sensirion demonstrates resilience and potential in high-tech sectors despite current profitability challenges and market volatility.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG specializes in developing, marketing, and selling integrated banking software systems to financial institutions globally, with a market cap of CHF4.25 billion.

Operations: Temenos generates revenue primarily through its Product segment, accounting for $879.99 million, and a smaller portion from Services at $132.98 million. The company focuses on providing integrated banking software systems to financial institutions worldwide.

Temenos, a Swiss software firm, underscores its commitment to growth with a 14.4% forecast in annual earnings, outpacing the broader Swiss market’s 11.8%. This trajectory is supported by robust R&D investments that align with revenue growth projections of 7.6% annually—exceeding the national average of 4.4%. Recent strategic executive hires aim to bolster its SaaS and U.S. market presence, enhancing its competitive edge in high-tech sectors. Additionally, the company recently completed a significant share repurchase program for CHF 200 million, reinforcing confidence in its financial health and future prospects.

Taking Advantage

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com