In the last week, the Swiss market has stayed flat, with notable gains in the Financials sector at 3.3%. Over the past year, the market is up 6.1%, and earnings are forecast to grow by 12% annually. In this context of steady growth and sector-specific gains, identifying strong dividend stocks like Julius Bär Gruppe can be a strategic move for investors seeking reliable income streams.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.07% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.70% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.60% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.82% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.60% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.28% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 4.03% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.69% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.50% | ★★★★★☆ |

We’ll examine a selection from our screener results.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Julius Bär Gruppe AG offers wealth management solutions across Switzerland, Europe, the Americas, Asia, and internationally with a market cap of CHF10.09 billion.

Operations: Julius Bär Gruppe AG generates CHF3.15 billion in revenue from its Private Banking segment.

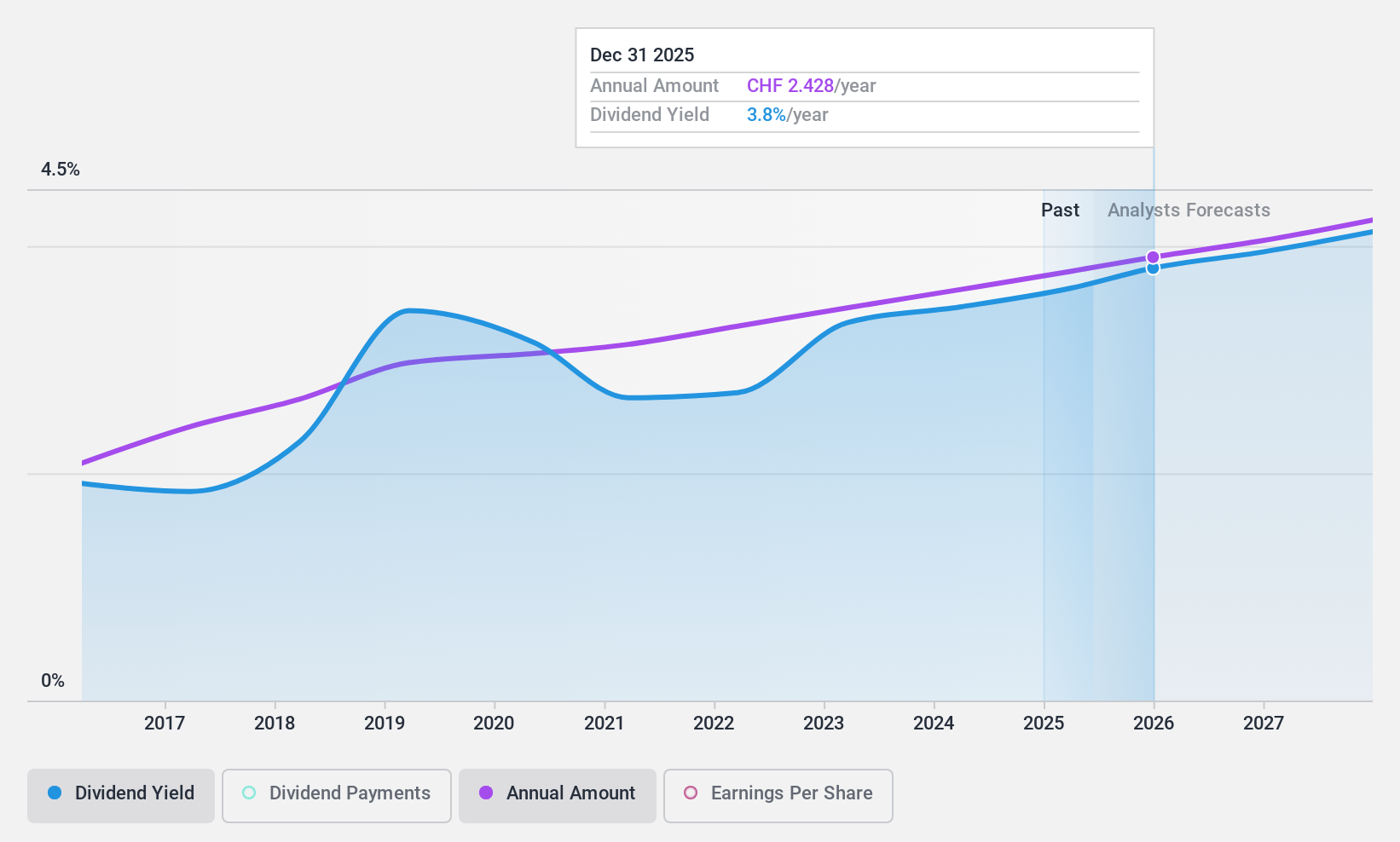

Dividend Yield: 5.3%

Julius Bär Gruppe offers a compelling dividend yield of 5.28%, placing it in the top 25% of Swiss dividend payers. However, its high payout ratio of 142.7% indicates that dividends are not well covered by earnings currently or forecasted for the next three years. The company’s dividends have been stable and growing over the past decade, but concerns about sustainability persist due to lower profit margins and a high level of non-performing loans at 2.1%.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DKSH Holding AG offers market expansion services across Thailand, Greater China, Malaysia, Singapore, the rest of the Asia Pacific, and internationally with a market cap of CHF4.18 billion.

Operations: DKSH Holding AG generates revenue from four main segments: Healthcare (CHF5.55 billion), Consumer Goods (CHF3.43 billion), Performance Materials (CHF1.38 billion), and Technology (CHF526.50 million).

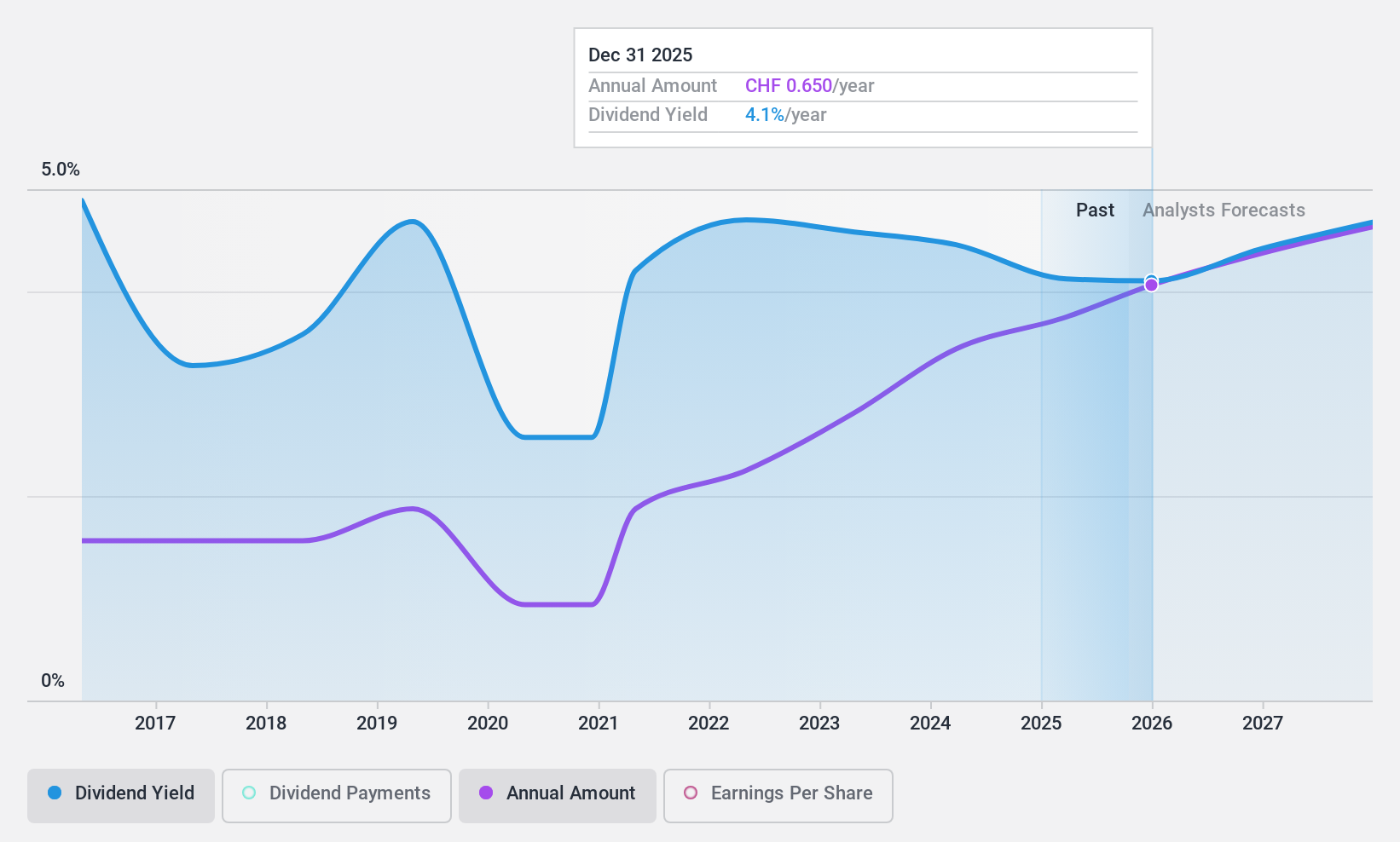

Dividend Yield: 3.5%

DKSH Holding AG reported half-year earnings with CHF 111.2 million in net income, up from CHF 103.4 million last year, despite a slight dip in sales to CHF 5.44 billion. The company’s dividends have been stable and growing over the past decade, supported by a payout ratio of 77% and a cash payout ratio of 45.8%. Trading below fair value estimates adds appeal, though its dividend yield of 3.5% is lower than top-tier Swiss dividend payers at 4.41%.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EFG International AG, with a market cap of CHF3.45 billion, offers private banking, wealth management, and asset management services through its subsidiaries.

Operations: EFG International AG’s revenue segments in millions of CHF are: Americas: 128.80, Asia Pacific: 176.70, United Kingdom: 193.30, Switzerland & Italy: 449.70, Global Markets & Treasury: 55.30, Investment and Wealth Solutions: 122.90, and Continental Europe & Middle East: 257.30

Dividend Yield: 4.8%

EFG International reported a net income of CHF 162.8 million for H1 2024, up from CHF 147.6 million last year, with earnings per share rising to CHF 0.51. The company completed a share buyback of 6 million shares for CHF 68.4 million and announced an additional repurchase plan valid until July 2025. EFGN’s dividend yield is in the top quartile of Swiss payers at 4.82%, with a sustainable payout ratio of around 55%, despite an unstable dividend track record over the past decade.

Summing It All Up

- Reveal the 25 hidden gems among our Top SIX Swiss Exchange Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com