The Swiss market recently closed modestly higher, buoyed by optimism that global central banks may further reduce interest rates to stimulate growth, with the SMI index posting a slight gain. In this environment of cautious optimism and selective gains among key players like Swatch Group and Lonza Group, identifying high-growth tech stocks such as Comet Holding can be crucial for investors seeking opportunities in Switzerland’s dynamic technology sector.

Top 10 High Growth Tech Companies In Switzerland

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

LEM Holding |

8.81% |

20.48% |

★★★★★☆ |

|

Santhera Pharmaceuticals Holding |

26.80% |

35.40% |

★★★★★★ |

|

ALSO Holding |

12.58% |

26.76% |

★★★★☆☆ |

|

Comet Holding |

20.47% |

48.55% |

★★★★★★ |

|

SoftwareONE Holding |

8.55% |

52.33% |

★★★★★☆ |

|

Cicor Technologies |

6.78% |

27.45% |

★★★★☆☆ |

|

Addex Therapeutics |

26.51% |

33.31% |

★★★★★☆ |

|

Basilea Pharmaceutica |

9.23% |

26.82% |

★★★★★☆ |

|

Sensirion Holding |

13.86% |

102.68% |

★★★★☆☆ |

|

MCH Group |

4.41% |

100.62% |

★★★★☆☆ |

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★★★

Overview: Comet Holding AG, along with its subsidiaries, offers X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and globally, with a market capitalization of CHF2.34 billion.

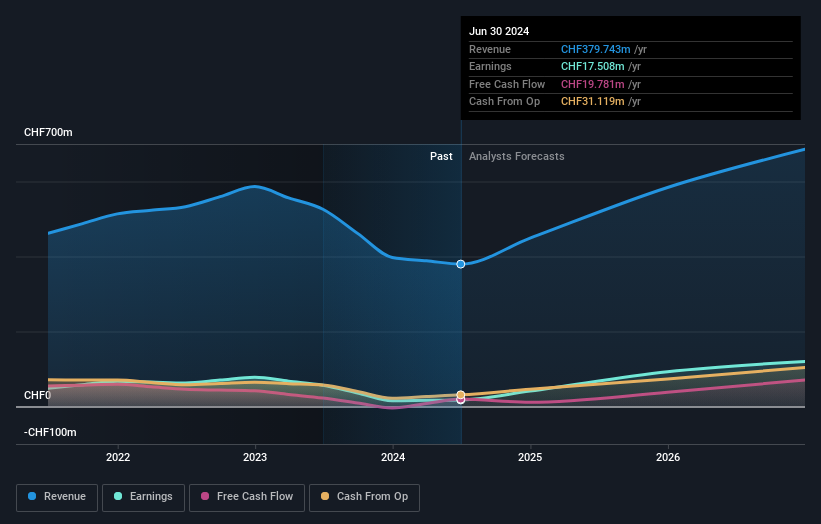

Operations: Comet Holding AG generates revenue primarily through its Plasma Control Technologies (PCT) segment, contributing CHF180.62 million, and its X-Ray Systems (IXS) and Industrial X-Ray Modules (IXM) segments, adding CHF115.34 million and CHF95.90 million respectively.

Comet Holding AG, despite a challenging market, reported a notable increase in net income to CHF 4.06 million from CHF 1.94 million year-over-year for the first half of 2024, reflecting a robust improvement in earnings per share from CHF 0.25 to CHF 0.52. This financial uplift coincides with their strategic emphasis on R&D which is evident as they continue to innovate within the tech sector—key for sustaining long-term growth amid rapid technological evolutions. Looking ahead, Comet is poised for significant advancement with expected annual earnings growth of 48.6% and revenue acceleration at 20.5%, outpacing the broader Swiss market forecasts of 11.6% and 4.2%, respectively, positioning them well within an increasingly competitive landscape.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG is a company that develops, produces, sells, and services sensor systems, modules, and components globally with a market cap of CHF1.02 billion.

Operations: Sensirion generates revenue primarily from its sensor systems, modules, and components segment, amounting to CHF237.91 million.

Sensirion Holding AG, amidst a challenging backdrop, saw its sales rise to CHF 127.97 million, up from CHF 123.23 million year-over-year as of June 2024, though it reported a net loss of CHF 36.01 million compared to a profit previously. This shift underscores significant R&D investments aimed at reversing the trend: expenses in this area are crucial for fostering innovation and future profitability. With earnings projected to surge by 102.7% annually and revenue expected to increase by 13.9% each year—outpacing the Swiss market’s growth—Sensirion is strategically positioning itself within the high-tech sector despite current unprofitability.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG specializes in developing and selling integrated banking software systems to financial institutions globally, with a market cap of CHF4.65 billion.

Operations: The company generates revenue primarily from licensing, maintenance, and service fees associated with its integrated banking software systems. It focuses on providing solutions to financial institutions worldwide.

Temenos AG, reflecting robust growth in the Swiss tech sector, reported a significant uptick in its Q3 2024 earnings with revenue climbing to USD 246.92 million from USD 236.7 million year-over-year and net income increasing to USD 30.85 million from USD 21.88 million. This financial uplift is underpinned by strategic executive appointments and a strong push towards AI-driven solutions, notably with Barb Morgan’s recent addition as Chief Product and Technology Officer aiming to enhance global cloud-based platforms for financial institutions. The firm also actively returned value to shareholders through a substantial repurchase of shares amounting to CHF 200 million, representing an assertive move in bolstering investor confidence while navigating market dynamics effectively.

Summing It All Up

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:COTN SWX:SENS and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com